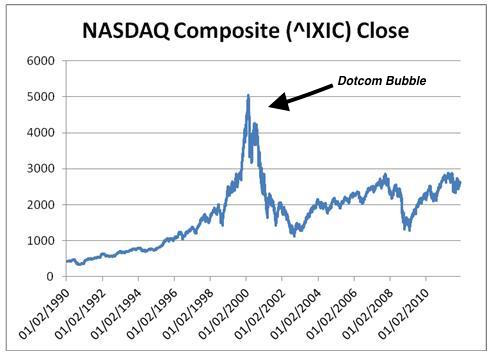

In light of the market correction that is occurring, I have pulled together some interesting and compelling quotes that help to put it into perspective:

“Yesterday was the third worst point decline for the Dow since 1915. But it was only the 284th worst day [as a percentage].” – Michael Batnick

“On days like today it’s easy to tell the Good Guys from the Bad Guys. The Good Guys are saying reasonable things, reassuring those who look to them for insight. The Bad Guys are squirting lighter fluid on the media bonfire, reveling in the fear of others, mocking the masses.” – Josh Brown

“Worst day in eight months. Eight. Whole. Months. An eternity.” – Blair H duQuesnay

“If you have a solid global asset allocation you could expect similar returns as the S&P 500 but with lower volatility and drawdowns. You can also expect to underperform about half of all years, by a mile (>10%) every 5 years, and easily underperform many, many years in a row.” – Meb Faber

“S&P 500: this is the 23rd correction >5% since the March 2009 low. They all seemed like the end of the world at the time.” – Charlie Bilello

“Minus 4% Dow Jones days are more common than you think. We’ve had on every 82 days on average since 1900.” Michael Batnick

“Since 1928 the S&P 500 has seen 325 days w/losses of 3% or worse. That means it happens roughly 3.5x a year on average.” – Ben Carlson