Defining one’s goals isn’t easy for some people. Trying to envision what your life will look like at some point in the future can be difficult. There are so many emotional and financial variables and so many unknowns in life that it can leave you feeling stuck or in a holding pattern until you find clarity. We know that because it is a relatively common issue that we run into with our clients and an issue we try to help resolve for them. Retirements, illness, or the death of a family member can be very disruptive.

We help clients find clarity by trying to quantify the financial impacts of their situation and model other scenarios they are considering.

To illustrate what we do, let’s consider a typical client situation. A couple with two college-age children have come to us looking for guidance in planning for their future. They have very good incomes and a vacation property, but there expenses are high and they have not saved as much as they should have in the past.

Here is our process to help get this client out of their holding pattern:

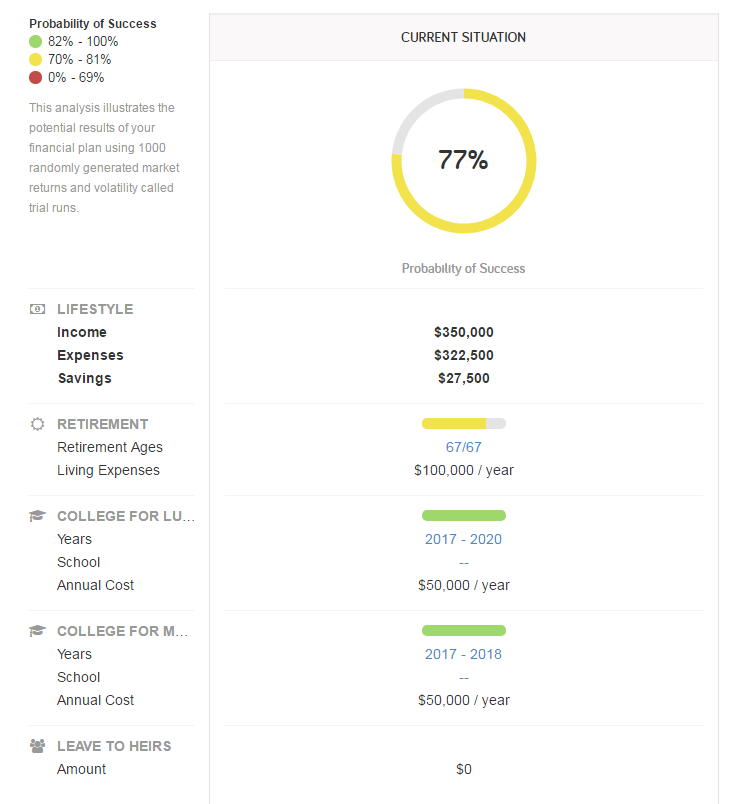

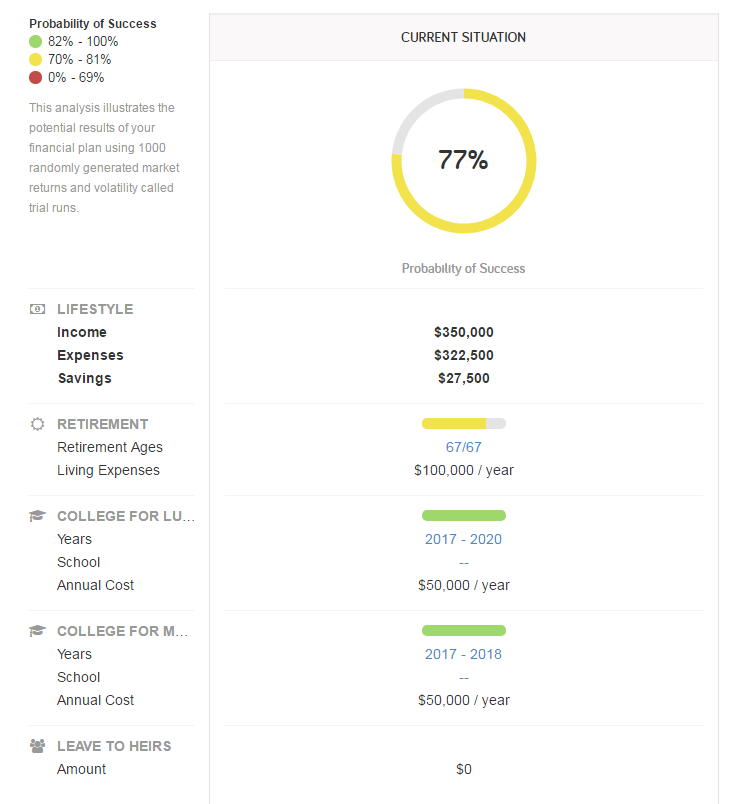

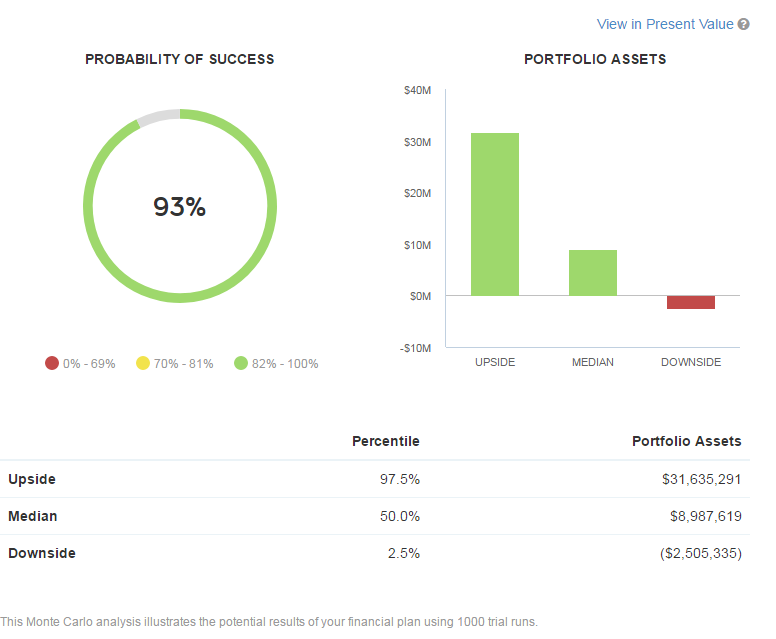

- We model their current financial situation and extrapolate those results out through their retirement. Every conceivable financial variable is used to model the current situation: income expenses, accounts, assets, social security, etc. The result is some perspective on the likelihood of maintaining the current lifestyle assuming nothing changes. The model is summarized in a simple graphic, an example of which is below.

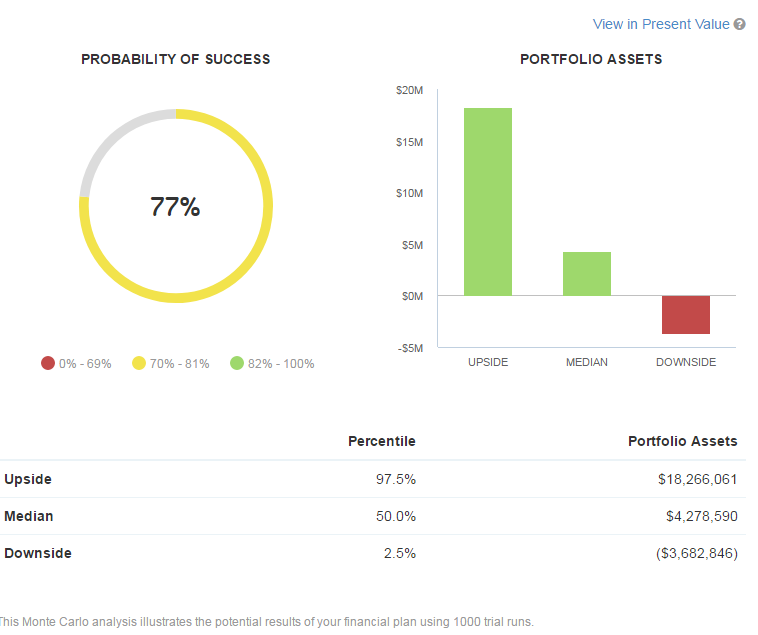

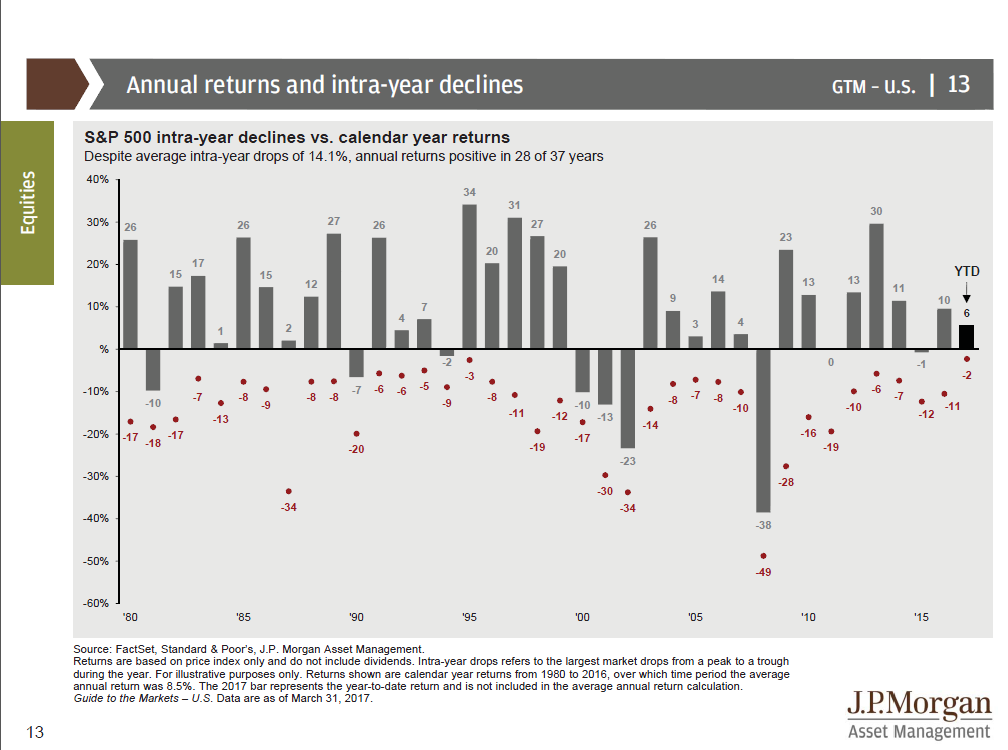

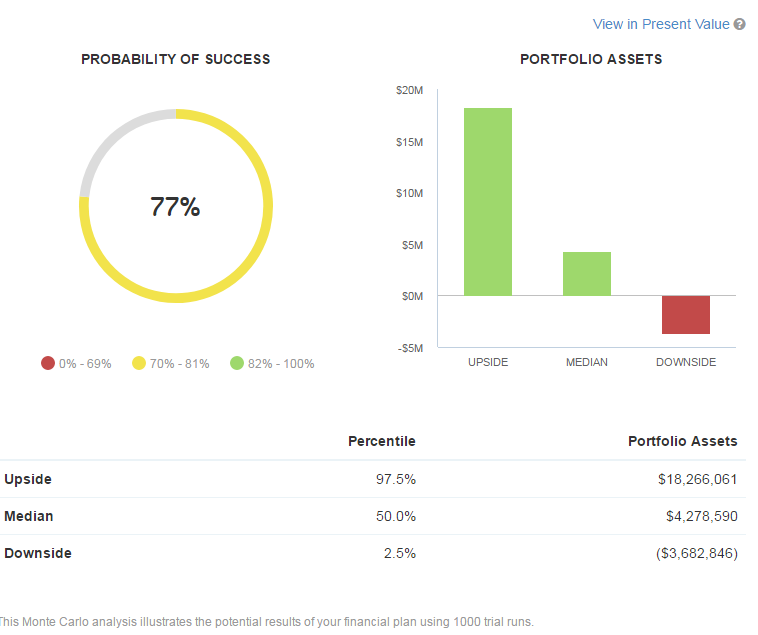

- The graphic above is presented to the client. The big circled number at the top provides a probability of success for the client to reach their financial goals. The calculation uses Monte Carlo Simulations to imagine sequence of returns risk. Basically, the model runs 1000 simulations to imagine how rates of returns affect a client reaching his goals. What happens if there is a big recession early in retirement? What happens if there is a big recession later in retirement? What happens if the markets are flat for several years? These are all scenarios that are modeled and considered and shows that of the 1000 simulations, 77% result in their goals being met:

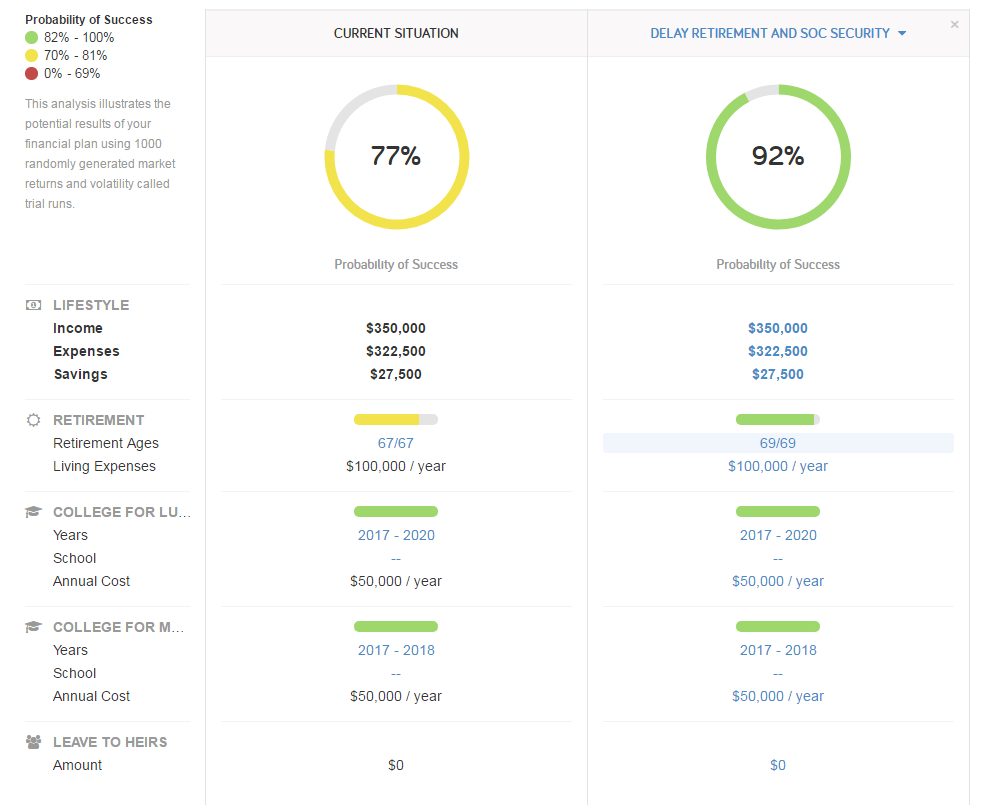

- In the first example above, it shows that their annual savings of $27,500 is used to successfully fund college education for two children as evident by the two green bars. But it comes at an expense -their retirement is not fully funded as seen by the yellow bar. This is where the conversation begins.

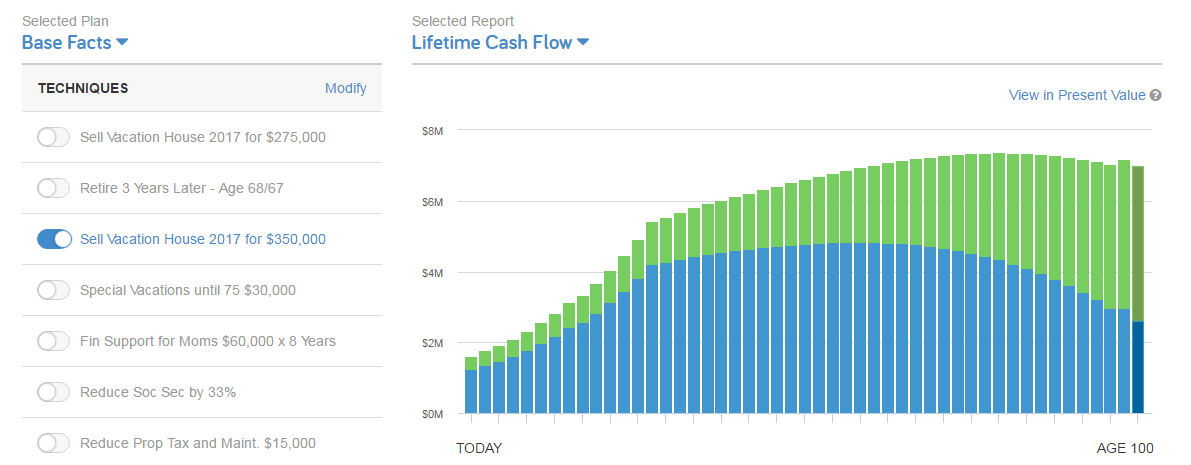

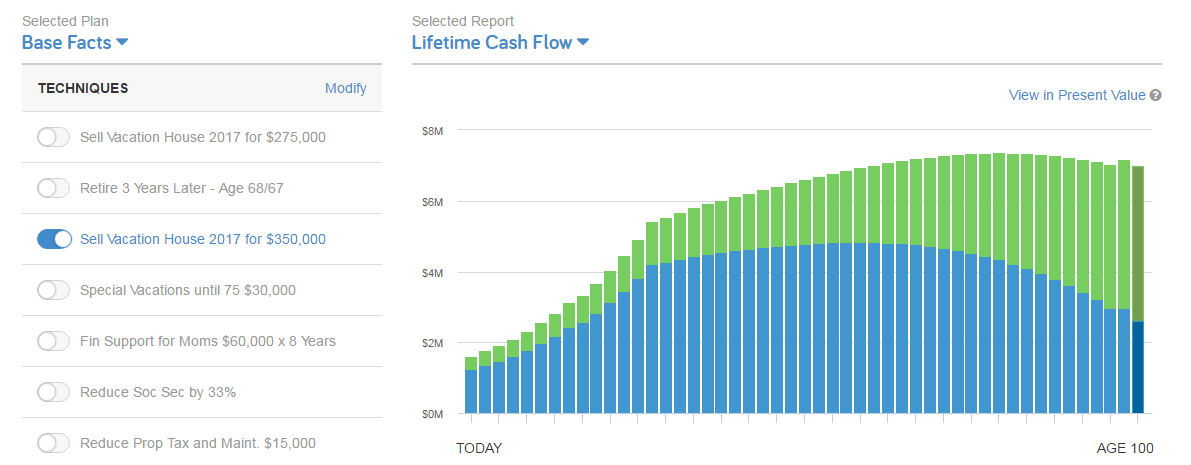

- We can begin to model changes on the fly to see how certain changes will affect their future in retirement. In this example, the client has been wondering if they should sell their vacation property and use the savings for retirement. We can quickly quantify the long term impact of that decision:

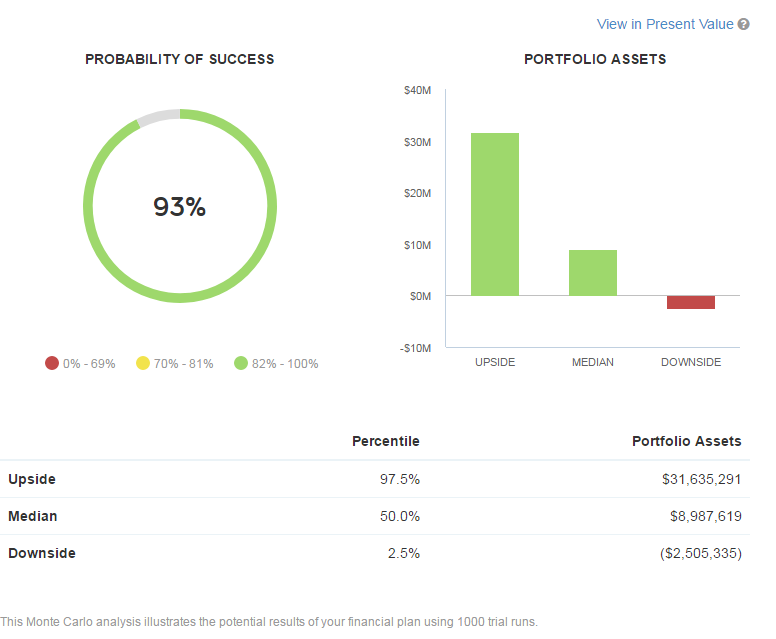

- Then we can see how that change will affect the probability of success. We can see below that by making this one change, we have increased the probability of success from 77% to 93%.

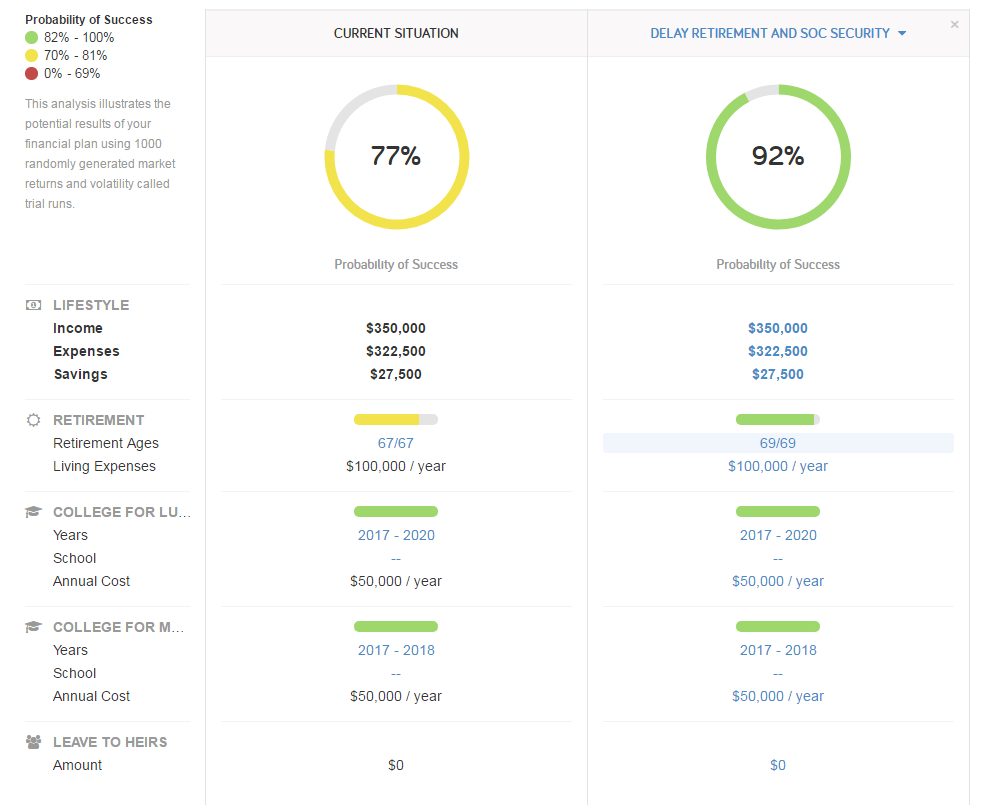

- Sometimes, this gives the client enough clarity to make a decision and move on. But that’s not always the case. After the client has thought about making a major decision (such as selling a vacation home), they may come back saying they can not actually sell their vacation property and need to consider other options. Below is a comparison of their current situation compared to a scenario in which they delay retirement for two more years. The result is almost the same as if they sold the vacation property.

After this exercise, the client has two viable options to consider to get them on track for retirement. By seeing certain scenarios modeled, it can make possible decision more real to them and hopefully more achievable. The illustration we provide help them make better decisions.

There are lots of emotional decisions that revolve around major life decisions, like retiring, changing jobs/careers, and moving. We believe that by addressing the financial impacts of these decisions, we can affect the emotional considerations that may be holding our clients back. Our goal is to provide that nudge to get them moving in the right direction and to keep them from making mistakes.

If you feel like you are stuck or need help laying a clear path forward, please reach out to us: